New standards on the debt trading market

Thanks to the BidFinance platform, customers get transparent, secure, fully digitized auctions on the debt market! The company's CEO Eugene Karastoyanov and Country Manager Piotr Szaciłło explain in an interview what the solution offered by the company is.

What is BidFinance? What is your service?

Eugene Karastoyanov: BidFinance is a platform dedicated to the sale of debt portfolios through auctions. Before BidFinance started operating, the sale of debt portfolios on the Polish market took place offline, e.g. the seller called buyers and offered such a portfolio for sale. Of course, this was done through traditional paths, via e-mail or phone, or it was done completely "on foot" - in closed rooms offers were collected in envelopes. Or, for example, in a cinema hall, when the auction was held in a very classic way by raising your hand.

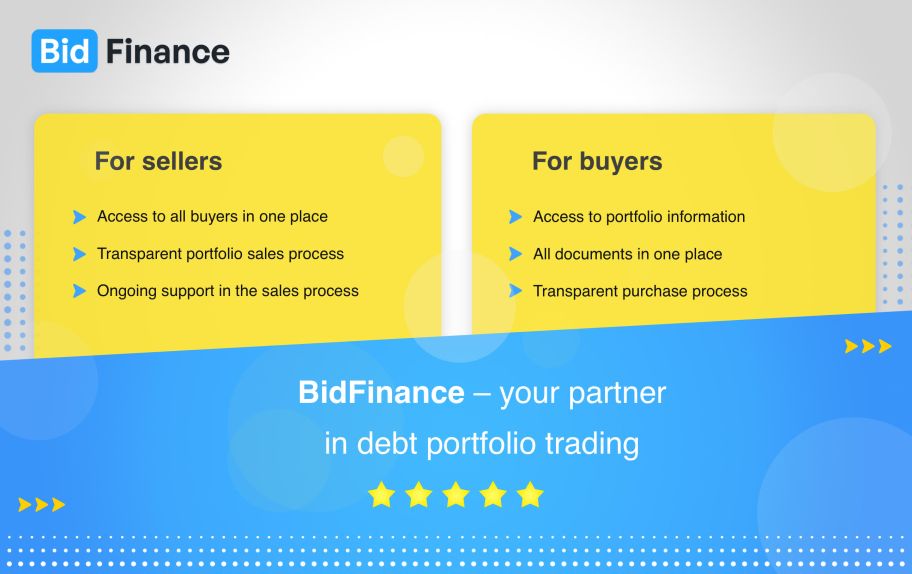

And this is where BidFinance and our digitized, automated, modern solution for the 21st century came in. We offer a platform where an online auction takes place. On the one hand, we have sellers, i.e. banks, loan companies, telecoms, energy and leasing companies, and on the buyers' side, and these are: funds, law firms and debt collection companies.

All buyers have access to the same data about a given portfolio, they price it, they usually have 10-14 days to do it, then there is an auction that lasts an hour and during this one hour we create an environment in which bidding takes place in real time, increasing the price step by step from the starting price. A seller who uses this platform gets the assurance that he is getting the highest price for his portfolio in these economic conditions.

How does your business compare to the competition?

EK: When we introduced our platform, we had competition in the form of intermediaries, i.e. people who knew the market and had contacts with buyers and knew who was selling receivables. We have taken most of this market from small intermediaries, because we automate a large part of the sales process. For example, when we receive a portfolio from the seller (it is in the form of an excel file that contains all the data about the debtors, e.g. when the loan was taken, how it was repaid, a lot of data about the customer, but of course anonymized), we put it into our system, which analyzes this data. The result of the analysis are charts that show buyers at first glance whether the portfolio is interesting to them. This, in turn, helps them make a quick decision, and significantly saves the time they would have to spend on self-analysis.

Is there a competitive platform in the market?

EK: Today, there is no platform of this type in Poland that offers an analogous solution.

What are the direct benefits for the customer using the BidFinance solution?

PSz: Thanks to our innovative auction engine, customers gain real added value – sellers can achieve the highest price for their portfolio at any given time. Unlike the traditional brokerage model, where data is sent to buyers for analysis and offers are submitted via email, which extends the entire process, our platform automates these activities.

Buyers are already present on our marketplace – we have over 45 active participants who are waiting for new data. When wallets appear on the platform, buyers receive automatic notifications, make a valuation immediately, and after 14 days, they can enter the auction.

We also act on behalf of sellers, intensively promoting their portfolios on the debt trading market. More buyers have access to detailed information about portfolios and prices achieved at auctions. Moreover, we have noticed that companies that list portfolios once again on the BidFinance platform obtain higher prices of receivables compared to previous auctions.

The growing number of interested buyers and bids translates into higher and higher price levels. With the BidFinance platform, sellers can also significantly reduce operating costs by automating processes such as handling buyers' inquiries via a dedicated chat available to auction participants.

What does the market potential look like? Who is the ideal customer for Bid Finance?

EK: As we have already mentioned - we are a marketplace - on one side we have selling companies, on the other - buyers.

Our ideal client is a company that often sells debt portfolios (preferably regularly) and they are of good quality. Of course, each company has its own patent on the frequency of selling debt portfolios. There are those that sell them once or twice a year, but there are also those that sell them every month. The more transactions we have on the platform, the better, of course. Our business model is based on the fact that we charge a fee on the sale of the portfolio, on the price that was achieved during the auction.

With digitalization, we have made the process of selling debt portfolios easier for companies by increasing the number and frequency. We have not changed the entire process that the seller had before, we are only modernizing, automating and improving it.

For example, companies that used to sell their portfolios once a year now have the opportunity to sell much more often. An additional benefit is that a more frequently sold portfolio means that it is younger and that the price for it will be higher.

PSz: One of the key advantages of our solution is that there is no need to integrate with banks or loan companies. Moreover, our platform is not subject to GDPR regulations because we do not process personal data. How does it work? When someone wants to sell a portfolio of receivables, they prepare an Excel sheet containing key information about the portfolio, such as contract number, debt status, interest rate, nominal value of the portfolio, etc., but without personal data.

On the BidFinance platform, the entire process is transparent, automated and compliant with applicable law. Debt collection companies do not have to make direct contact with the seller – they just need to wait for an email notification from BidFinance. The e-mail contains information about the planned auction, available documents to download and the possibility of starting a portfolio analysis.

Our vision for the future, which we plan to realize in 2-3 years, is to automate even more. Ultimately, debt collection companies will not need direct contact with sellers. Buyers will simply wait for a notification from BidFinance about a new debt portfolio, download data, value the portfolio and after a certain period of time – usually two weeks – join the auction.

What does marketing look like in your company, do you build visibility and to what extent is it necessary in this industry?

PSz: We are active on LinkedIn, where we build the BidFinance brand and share references from recognized institutions, including state-owned companies. We also acquired ambassadors of our solution – these include people managing debt collection processes who sold portfolios via the BidFinance platform. Their satisfaction with BidFinance's services makes them willing to recommend us to other potential business partners.

Word-of-mouth marketing is also very effective. For example, when a company from a given industry has carried out a successful campaign with us, the information about it quickly spreads throughout the industry, not only in the debt trading industry. As a result, we are opening up new doors to institutions that can benefit from the sale of debt portfolios via the BidFinance platform. Thanks to this, we gain trust and expand our reach on the market.

At what point in the company's development is it now?

EK: We have product market fit, which means that we are sure that our platform is the product that the market really needs. We are also at the stage when we see what can be done better, what functionality to add to increase the demand for our solution. We are also at the beginning of international expansion. We have a product where no integration is needed, easy to scale. Thanks to this, we are able to introduce it to new markets quite quickly.

PSz: We work with international companies, which naturally opens the way for us to expand into new foreign markets. Comparing 2024 to 2023, we achieved an impressive nine-fold increase in revenue. This clearly shows that our service has a place in the market and huge potential for further development.

We are noticing a growing interest from international groups and companies that have started working with us in Poland, selling their portfolios, and now want to expand their operations to foreign markets.

An example is an international bank, for which we have already conducted three auctions in Poland. We are currently in talks about the implementation of the BidFinance platform in other markets where the bank operates. This is proof of the effectiveness and versatility of our solution.

What are the other prospects for the near future? How do you see the development of the product?

EK: We have built an MVP, we have a product roadmap that contains three main pillars, the first is the platform functionalities that we can add now and that immediately start generating revenue, e.g. adding more types of auctions, or adding a tool to negotiate an assignment agreement after the portfolios are sold.

The second pillar is the development of analytical tools that will increase the value of our platform for both sellers and buyers. An example is a portfolio valuation tool or a recommendation system that suggests when it is best to put a portfolio up for sale. These functionalities will allow us to increase user engagement and improve the quality of transactions on the platform.

The third pillar is long-term investments in technologies that can revolutionize the portfolio trading market, such as blockchain integration, the introduction of smart contracts, or the use of AI to automate processes related to risk assessment or collection. These solutions are aimed not only at improving the efficiency of our platform, but also at building a competitive advantage on an international scale.

Each of these pillars is linked to our financial and strategic goals, and the implementation of the roadmap will allow us to scale our business in Poland and enter new European markets.

PSz: We plan to use artificial intelligence (AI) to further improve our processes, which are characterized by high repeatability. We are currently working on the implementation of machine learning technology, which can support potential buyers in the valuation of portfolios. This solution will make the analysis process more efficient, precise, and automated, benefiting both buyers and sellers.

Do you need to complete the fundraising process to implement the changes and improvements described above?

EK: We are not in a situation at the moment to implement it with current funds. Every investor needs an equity story - our vision, road map, description of how we intend to implement it all. That is why we are now focusing on their precise preparation.

Thank you for the interview and I wish you perfect customers!

Interviewed by Ewa Pysiewicz, November 2024

Eugene Karastoyanov - Founder and CEO of BidFinance. He holds 4 master's degrees, obtained in three different countries, including an MBA from Frankfurt Business School and an MSc from Kozminski University in Warsaw. He has extensive experience gained in the venture capital, private equity and management consulting sectors. As CEO of BidFinance, he creates and implements the company's overall vision. Through strategic planning and effective implementation of products and processes, it aims to position BidFinance as a leader in the financial technology sector.

Piotr Szaciłło - He is a graduate of the Poznań University of Economics and Business in the field of banking, he completed postgraduate studies at the Kozminski University in Warsaw. He has 15 years of experience in B2B sales and business development, he has successfully acquired clients from the financial, energy, gas, fuel, FMCG and debt collection industries.

At BidFinance, he is responsible for building relationships with key clients.