10 commandments of a good deck

- Posts: Blog

- Main paragraph: In many sources you can find information on what a good pitch deck should look like and what to include. But how do you create one? You will find out in the article below.

There are many articles or publications that clearly tell you what and how many slides a good pitch deck should consist of. In principle, it is a simple presentation that uses all the knowledge that founders have about their startup. And yet, many pitch decks contain errors that often determine the company's existence or non-existence and are an obstacle to obtaining financing.

Let's start with what a pitch deck really is. The dictionary definition is quite long and is as follows:

The most important in this definition are a few key words - a short presentation, on a dozen or so slides, presenting the startup in such a way as to convince investors and obtain financing, often deciding about the company's existence or non-existence.

Where to start creating a pitch deck. It is worth playing the role of a small child while preparing it. Probably many of you have or have had a small child around you who is exploring the world. At a certain stage, there is a tendency to ask constant questions - why, and what for? Regardless of how the answer is given, there is almost always another "why?".

When preparing a pitch deck, it is worth asking yourself such simple questions at the very beginning - why, how, when, why now, with whom, for how much, They allow you to build a story - the story of your idea, your startup, which you will then be able to "sell" to potential investors. From these simple questions, you will be able to develop information about what problem on the market your solution - product/service - takes care of, why you are solving it, why now is a good time to enter the market with such a solution, why your team has a chance to solve this problem, who you will compete with on the market, how big the market is, how much and how you will earn on your idea and how much funds you need to implement it.

With the narrative built in this way, you can start building the deck. By browsing through the available sources, it is very easy to find what such a presentation should contain. Lech Kaniuk wrote about it in his book "Angel in Hell" or Szymon Janiak in his book "Start-up and venture capital. What should you do to effectively obtain financing for your company?". Synthesizing information from these and other publications, it can be assumed that a good deck contains the following slides:

- problem - what market problem have you diagnosed as important for your end customers?

- solution - how do you plan to solve this problem

- product - what the tool (product) you are building to solve the problem will look like

- team - who will build the startup and be responsible for its key elements

- market - the size of the market in which you will operate

- business model - how do you plan to make money on the solution

- competition - who will you compete with on the market

- finance - forecasts of costs and revenues for the coming years

- "the ask" - how much capital you are looking for and what part of the shares you are able to give away for it.

With a story built, you are able to easily prepare most of these points. Of course, especially in the case of the so-called "first founders", it can be difficult to prepare financial forecasts or a business model, and even questions asked yourself will not be able to help. If you have a CTO or CFO on board, you have a solution. But if not, it is worth using widely available knowledge, either from the publications mentioned above or in the form of pitch decks of other startups, often the larger and more experienced in raising capital, and follow their ways of showing the market or business model.

When arranging a story into a deck structure, it is also worth avoiding certain mechanisms and errors that can interfere with its reception. Below are the subjective 10 commandments of preparing a good pitchdeck. Of course, there could be many more. If we were to convene a "council" of VC funds or investors, the list could have 100 or 200 of them, but each of them would point to a few of the most important ones. This is also the case with the following ten.

Importantly - these tips may seem simple or even trivial, but after analyzing several thousand decks that have been received by our fund over the last 4 years, even these seemingly "trivial" rules have often not been applied.

Commandment 1:

Do your homework and check who you are talking to - whether you will be talking to someone who is supposed to be an investor, or a client, or a person experienced in finance, or a person experienced in technology. All this matters and affects the next steps in building a pitch deck.

Commandment 2:

Choose the material for the interlocutor - after following the first commandment, in the next step you should choose the material for the interlocutor. If our startup operates in the deep tech sphere, and on the other side we have a person experienced in sales or HR (because it happens anyway, VC funds or investors are not obliged to know everything), then too industry-specific language and going into technological details will make the other party misunderstand your idea.

Commandment 3:

Highlight your strengths - but wisely. If you want to say that your solution is "the best in the world" - do it, but support it with appropriate evidence (market research, analysis, etc.). The desire to be the best in the world supported by evidence that this is the case or can be so is not an inflated ego. It is getting to know and defending one's value.

Commandment 4:

Don't hide your flaws – be honest and clearly communicate if you don't have something at a given stage yet – whether it's an area not yet covered by the team's competences, or some functionalities in the product that will be added in a moment. Not to mention more complicated and invisible at first glance matters (legal, property rights, etc.). Most funds and investors will do their research anyway and ask the market about your project, in addition, before signing the due diligence agreement, they will most likely show "corpses in the closet".

Commandment 5:

Be flexible - do dry runs, test the choice of material and practice it in a closed group. Be prepared for the proverbial everything, so that you are not surprised by any question or situation.

Commandment 6:

Avoid the curse of knowledge - as the one who knows the most about his idea, avoid overloading your deck with knowledge. On the other side, there can often be someone who does not have to be an expert in a given field. Too much content, especially specialized content, can overwhelm him and disrupt the message that was supposed to reach him. Language adapted to the recipient is the key.

Commandment 7:

Also, beware of too much text and content on your slides. They should only include the main messages, the most important ones that should resonate and that best reflect the topic of a given slide.

Commandment 8:

Support yourself with data where possible - whether it is data collected by yourself to authenticate the market need for your solution, or data from various types of industry reports, etc. In the age of the Internet and many research institutions, access to data is much simpler.

Commandment 9:

Stand out - VC funds and investors receive hundreds of deck emails from startups looking for capital. Each of them potentially contains a presentation or a link to the presentation. We are a society that absorbs more and more content in short video forms, reels, etc. Such a form of presentation? Maybe this is the future.

Commandment 10:

Don't make mistakes - none, neither logical nor spelling. Make sure that both in terms of data and spelling, the deck is flawless. The story must be consistent and reach the recipient. If you come across a fan of data and there is an inaccuracy in the deck - the story will be marked by this error until the end. If you come across a spelling fanatic, and there is a spelling mistake on one slide - he will look for more mistakes until the end of the deck and not focus on the message. Take care of it, because the first impression is made only once.

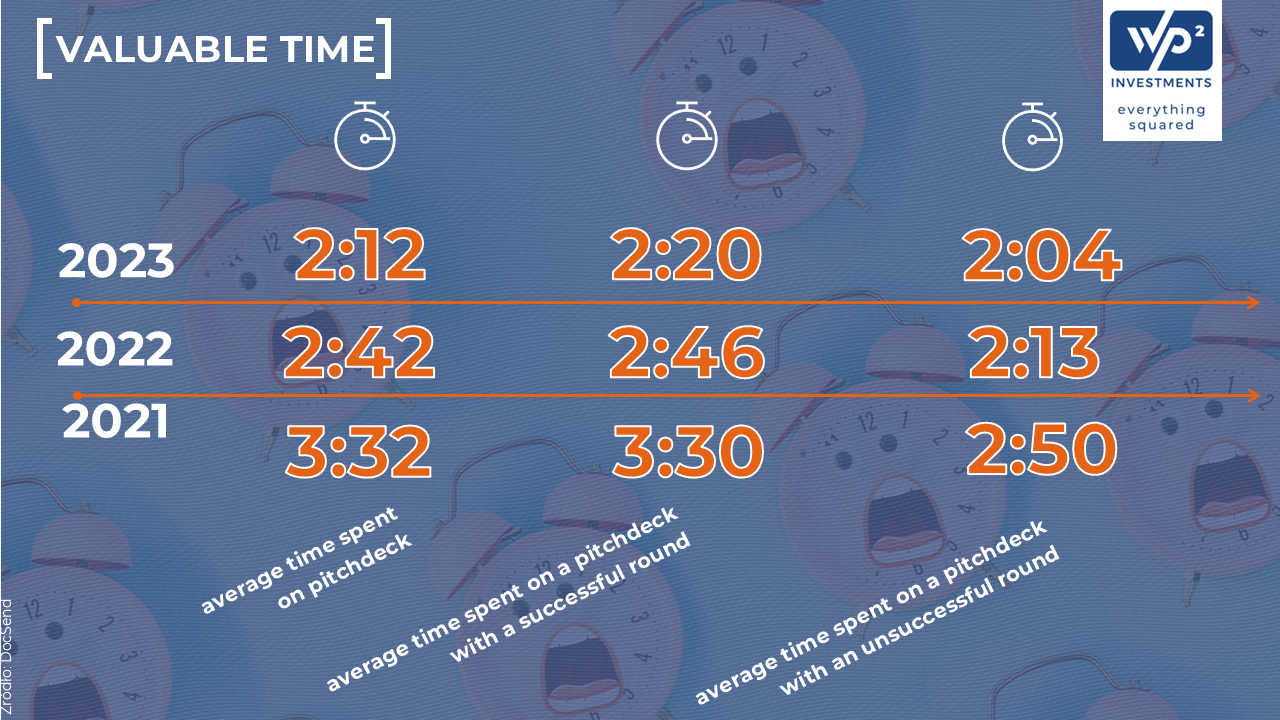

With a ready deck, you will fight to take away something that is very valuable to investors. And it is not just money. It's all about time.

According to DOCSEND data, the amount of time spent on decks is very small. This is due to the amount of money that goes to the mailbox, the limited human resources of VC funds. That's why it's so important to prepare a deck that will attract attention.

You can't create one pitch deck that will satisfy everyone. Therefore, you cannot focus only on its content (which, as I mentioned, many other publications have treated). The approach to its preparation is also important. Therefore, let the above list be an inspiration for the creation process, thanks to which you will be able to create decks even for the most demanding recipients.

Szymon Górak - Investment Director at WP Kwadrat. He supports companies in the fundraising process, including the preparation and adaptation of decks for investor talks.

Read more …10 commandments of a good deck

- Hits: 791